Taxes capital gains as income at a flat rate of 4.95%. South Carolina taxes capital gains as income (with a 44% deduction available on long-term gains) and the rate reaches 7%. Taxed as capital gains income and reaching 5.99%. Taxed as capital gains income at a flat rate of 3.07%. There is a 100% capital gains deduction available for income from particular kinds of investments. Taxed as capital gains and the rate reaches 5%. Taxed as income and the rate reaches 4.8%. Taxed as income (with a deduction allowed of 40% of capital gains income) and the rate reaches 2.9%. Taxed as income and at a flat rate of 5.25%. The state taxes capital gains as income (allowing a deduction of 40% of capital gains income or $1,000, whichever is higher) and the rate reaches 5.9%. Taxed as income and the rate reaches 6.84%. Taxed as income and the highest income tax rate is 6.90%, but with a 2% capital gains credit, this rate is technically 4.9%.

Taxed as income and the rate reaches 5.4%. Taxed as income and at a flat rate of 4.25%. Long-term capital gains are usually taxed at a flat rate of about 5% but there are some types of capital gains that the state taxes at 12%. Taxes capital gains as income and the rate is a flat rate of 3.23%. Taxes capital gains as income and the rate is a flat rate of 4.95%.

Taxes capital gains as income and the rate reaches 5.75%. Taxes capital gains as income and the rate reaches 6.6%. Taxes capital gains as income and the rate reaches around 6%.Ĭolorado taxes capital gains as income and the rate reaches 4.63%.Ĭonnecticut’s capital gains tax is approximately 7%. Taxes capital gains as income and the rate reaches 4.5% Taxes capital gains as income and the rate reaches 5% Image shows and calculator and charts that could be used to understand how tax rates differ by state.Īs for the other states, capital gains tax rates are as follows: Taxes capital gains as income and the rate reaches 8.53%. Hawaii taxes capital gains at a lower rate than ordinary income. The 10 states with the highest capital gains tax are as follows:Ĭalifornia taxes capital gains as ordinary income. States With the Highest Capital Gains Tax Rates The rates listed below are either 2021 or 2020 rates, whichever are the latest available. states have an additional capital gains tax rate between 2.9% and 13.3%. Tennessee and New Hampshire specifically tax investment income (including interest and dividends from investments) only, but not wages.Ī majority of U.S.

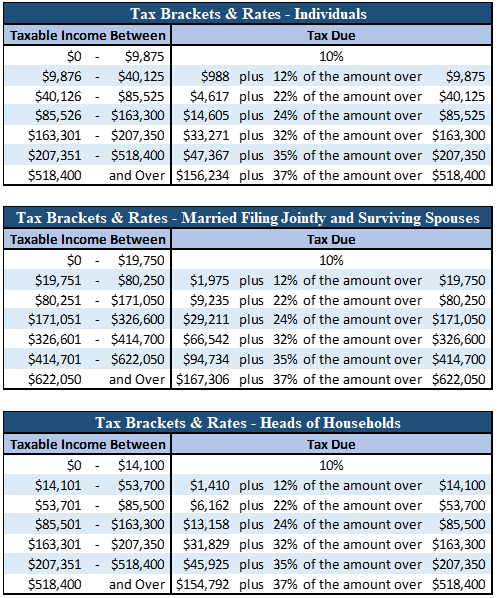

This is because these nine states do not have an income tax. The following states do not tax capital gains: Short-term gains are taxed as ordinary income.Īfter federal capital gains taxes are reported through IRS Form 1040, state taxes may also be applicable. Short-term capital gains come from assets held for under a year.īased on filing status and taxable income, long-term capital gains for tax year 2021 will be taxed at 0%, 15% and 20%. Long-term capital gains come from assets held for over a year. Let’s break down how capital gains are taxed by state in 2021.Ĭapital gains vary depending on how long an investor had owned the asset before selling it. A financial advisor could help you figure out your tax liability and create a tax plan to maximize your investments. And short-term capital gains are taxed as ordinary income. The federal government taxes long-term capital gains at the rates of 0%, 15% and 20%, depending on filing status and income. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. The post-it reads, "Tax Time." It's important to understand capital tax rates in your state when going over investment taxes. Image shows a post-it on a desk, next to a desk plant, calculator and other office supplies.

0 kommentar(er)

0 kommentar(er)